Sidley Updates

The Midstream Energy REIT: Has Its Time (Finally) Come?

The market for midstream energy master limited partnerships (MLPs) (approximately $250B market capitalization at the end of September 2019) has suffered from a lack of growth momentum in recent years, while the public real estate investment trust (REIT) market (approximately $1T of market capitalization at the end of September 2019) has, by contrast, experienced significant growth.1 These two trends, combined with the fact that some well-known asset managers have recently converted their MLP-like publicly traded partnership (PTP) structures into traditional corporate structures after the enactment of the Tax Cuts and Jobs Act of 2017, which reduced the corporate tax rate from 35 percent to 21 percent, have renewed market participants’ interest in the midstream energy REIT structure. A principal reason for those PTP conversions was to expand the universe of potential investors, thereby substantially increasing the demand for such securities, which is expected to result, over time, in higher stock price levels. This Sidley alert reviews the midstream (i.e., infrastructure such as pipelines and storage facilities) energy REIT alternative to midstream MLPs.

Background

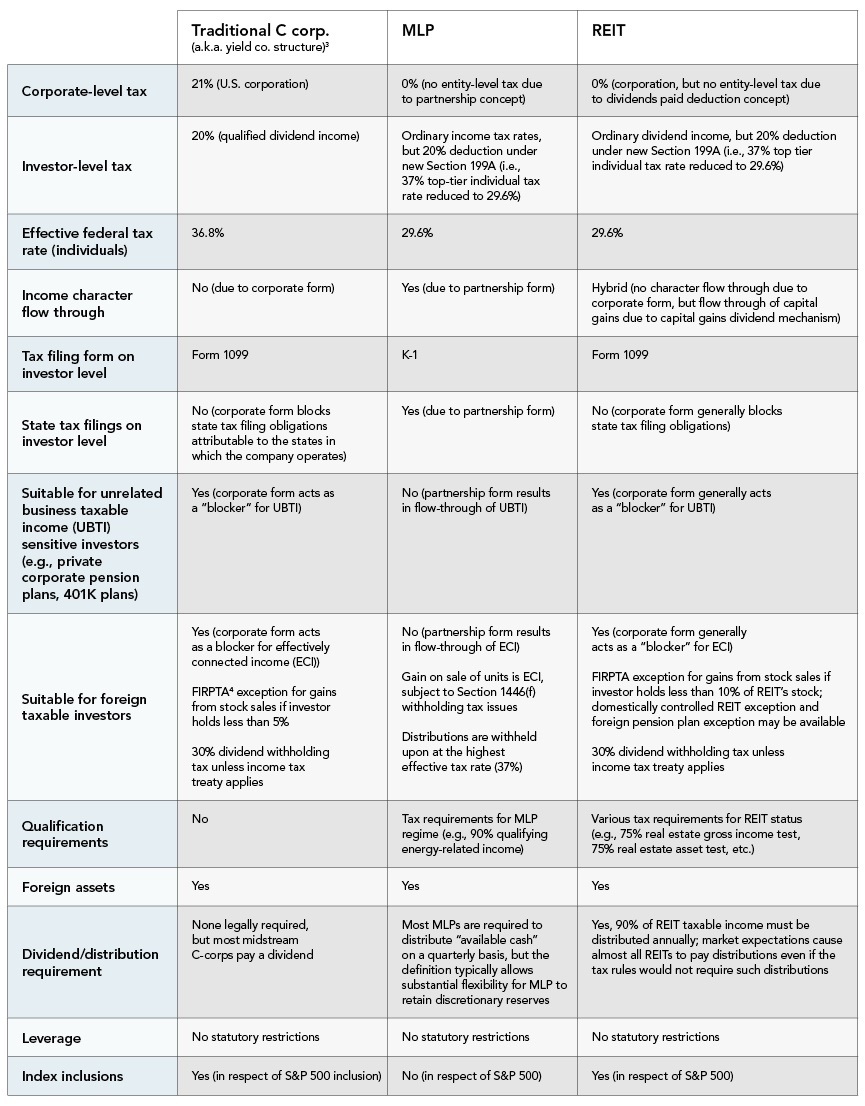

Available Structuring Options. The following table summarizes three options for a midstream energy company that intends to undertake an initial public offering (IPO):2

REIT Qualification as Key Tax Issue. To qualify as a REIT for tax purposes, the relevant entity needs to annually satisfy a host of REIT qualification tests, including the annual 75 percent gross income test and the 75 percent asset test, which are designed to ensure that the bulk of a REIT’s income and assets are sufficiently related to real estate.

- In this regard, the REIT rules have been significantly clarified. For example, the recently finalized regulations concerning which assets constitute “real property” for purposes of these REIT tests clarify that pipelines and storage tanks may be regarded as good real estate assets.5

- Despite their complexity, the REIT rules permit different business models: (i) The REIT leases the midstream assets to an unrelated operator, (ii) the REIT operates the midstream infrastructure assets or (iii) the REIT provides specialty financing in connection with midstream assets. In this regard, a recent private letter ruling (PLR 201907001 — the Midstream 2019 PLR) provides significant additional guidance for the REIT as an “operator” model. In this Midstream 2019 PLR, the Internal Revenue Service (Service) clarified that (i) leases in respect of an offshore oil and gas platform are good real estate leases for REIT purposes (i.e., income from such leases results in good real estate rental income for purposes of the 75 percent gross income test), (ii) the service fees that users of storage tank facilities will pay to a REIT under the relevant storage agreements also qualify as good real estate rental income for purposes of the 75 percent gross income test and (iii) the pipeline use fees that users of oil and gas pipelines pay to a REIT under the relevant pipeline use agreements will constitute good real estate rental income for purposes of the 75 percent gross income test.6

Observations

- Evolution of REIT Rules Makes the Midstream Energy REIT Very Attractive.

Changes and clarifications in the REIT rules in the last several years have made the REIT rules more suitable and more attractive for the midstream energy REIT alternative (e.g., “real property” regulations, beneficial changes to the FIRPTA regime, Midstream 2019 PLR). Accordingly, midstream asset sponsors and investors should carefully consider this structuring option. In particular, it is clear that the capital markets have a strong preference for vehicles that provide investors with Form 1099 reporting as opposed to K-1 reporting. The recent decisions of well-known asset managers clearly suggests that the ability to access a significantly greater portion of the potential investor universe that is afforded by the structural change outweighs most other considerations, including tax efficiency. Unlike those asset managers, however, midstream energy sponsors and investors often do not need to choose between a taxable corporation and a more tax efficient MLP structure. Instead, the REIT vehicle, if properly structured, may, in certain circumstances, be the optimal choice.

- The Public REIT Market Has a Good Track Record in Respect of New Asset Classes.

The public REIT market has, over the years, proven to be open to new asset classes. The recent successes of data center and cell tower REITs are good examples for new asset class REITs.

- International Acceptance of the REIT Structure.

The REIT vehicle has enjoyed broad-based acceptance internationally as more and more foreign countries have adopted their own REIT regimes. Accordingly, a REIT structure should be able to access a significant foreign investor base, particularly in light of the fact that REITs are includable in stock indices such as the S&P 500 and the favorable treatment REITs have under the FIRPTA regime.

- Activist Investor’s Playbook.

It is likely that the midstream energy REIT structure will, in the near future, enter the playbook of activist investors. Accordingly, public midstream MLPs and C corporations should carefully consider this restructuring option as part of their activist preparedness program.

- Private Midstream Energy REIT Structure.

It is worth noting that the REIT structure can be adopted prior to an IPO (i.e., private midstream energy REIT structure). Such an approach will, for example, generally allow for a speedier IPO process (i.e., no complex tax-free REIT conversion from a partnership or corporate structure required at the time of the IPO). Such a structure may be particularly attractive in certain cases in which a sponsor of midstream assets buys and finances those assets with capital from certain institutional foreign investors.

- PLRs May Be Advisable.

The Midstream 2019 PLR demonstrates that consistent with long-established practice in the REIT IPO market, taxpayers often seek to obtain a PLR in connection with an IPO. Such a PLR process is, depending on the facts and circumstances, very time consuming (it is generally difficult to determine upfront how long this process will take), requires significant planning and needs to be reflected in the timeline for the IPO (i.e., effect of PLR process on optimal IPO window). That said, taxpayers should carefully consider with their REIT counsel whether such a PLR is, in fact, necessary.

Sidley’s REIT Practice

Sidley fields a top-tier, seasoned REIT team dedicated to providing outstanding client service and innovative legal solutions. Sidley has handled more U.S. REIT capital markets transactions over the last one-, three-, five- and 10-year periods based on deal size than any other law firm. Sidley has served as counsel on seven of the last eight REIT IPOs in the U.S.

Sidley’s Energy Practice

With more than 150 practitioners in 15 offices, Sidley’s leading energy practice advises clients across the globe in every sector of the market. We provide exceptional, commercial-minded advice to midstream clients in a broad range of capital markets, master limited partnerships, mergers and acquisitions, project development, project finance and syndicated financing transactions. Sidley has advised on 270+ midstream transactions and financings in the last five years, valued at over $121 billion.

1 See www.REIT.com.

2 All “Section” references are references to the U.S. Internal Revenue Code of 1986, as amended, and all “Treas. Reg.” references are to the Treasury Regulations promulgated thereunder.

3 As in the case of some Yieldcos, a midstream company could be formed as a limited partnership or limited liability company for state law purposes while electing to be treated as a corporation for tax purposes. In addition, an entity electing to be treated as a corporation could use the “UP-C” structure, which would allow a sponsor or other investors to retain all or a portion of their respective equity interests following the IPO through a subsidiary limited partnership or LLC with pass-through tax treatment.

4 The rules commonly known as FIRPTA (i.e., Section 897 and 1445) provide, generally speaking, that a foreign investor will be subject to U.S. federal income tax on its gain from its direct or indirect disposition of U.S. real estate, including the stock of a U.S. real property holding corporation.

5 However, the Midstream 2019 PLR indicated that not all operating activities conducted by pipelines and storage tanks would generate qualifying REIT income.

6 In the Midstream 2019 PLR, the taxpayer represented to the Service that (i) the offshore platform, (ii) the storage tanks and (iii) the pipelines are good real estate assets for REIT purposes (i.e., the 75 percent real estate asset test).

Attorney Advertising—Sidley Austin LLP is a global law firm. Our addresses and contact information can be found at www.sidley.com/en/locations/offices.

Sidley provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers. Sidley and Sidley Austin refer to Sidley Austin LLP and affiliated partnerships as explained at www.sidley.com/disclaimer.

© Sidley Austin LLP

Contacts

Capabilities

Suggested News & Insights

- Stay Up To DateSubscribe to Sidley Publications

- Follow Sidley on Social MediaSocial Media Directory