Securities Enforcement and Regulatory Update

SEC Division of Enforcement Annual Report Reveals Record Highs and Lows

On November 18, 2021, the Enforcement Division (Division) of the U.S. Securities and Exchange Commission (SEC or Commission) released its annual report, which detailed the agency’s enforcement efforts during fiscal year 2021 (October 1, 2020 – September 30, 2021).

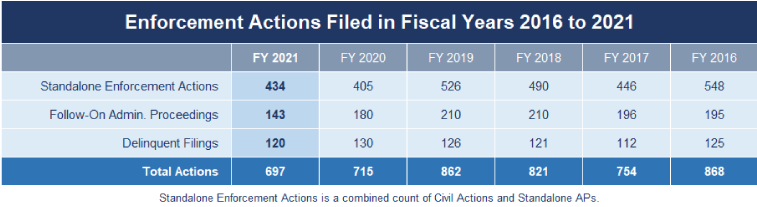

The Division reported that it brought a total of 434 standalone enforcement actions, up from 405 in the previous year. However, despite the lessening of COVID-19 restrictions, the total number of enforcement actions decreased, from 715 in 2020 to 697 in the current year. Notably, this is the lowest number of enforcement actions since 2014.

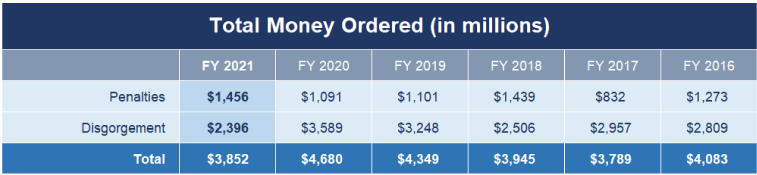

Despite the overall decline in enforcement actions, the Division obtained judgments and orders for more than $1.4 billion in penalties, which is the highest total since 2016. However, disgorgement — the forfeiture of ill-gotten gains — was just under $2.4 billion, the lowest amount since 2016. Moreover, the Division distributed only $521 million to harmed investors, less than half the amount of 2019 and the lowest amount since 2017. The substantial increase in penalties and decrease in disgorgement may be a result of recent judicial decisions and legislation. In Liu v. SEC, the Supreme Court concluded that an SEC disgorgement award may be considered equitable relief permissible under Section 21(d)(5) of the Securities Exchange Act of 1934 if the award does not exceed a wrongdoer’s net profits and is awarded for the benefit of victims. In addition, Congress’s passage of the National Defense Authorization Act authorized the SEC to seek “disgorgement ... of any unjust enrichment by the person who received such unjust enrichment as a result of such [a securities law] violation.” The Act also expanded the statute of limitations to seek disgorgement from five years to ten years for scienter-based claims but not for non-scienter claims. As a result, in certain matters, such as insider trading cases, where the SEC has difficulty in identifying harmed investors or is time-barred from obtaining disgorgement for earlier conduct, there has been a shift from the SEC seeking disgorgement to only imposing penalties.

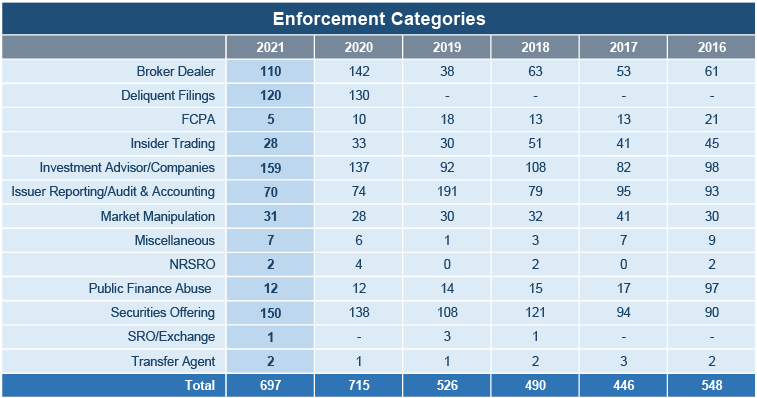

A review of the categories of enforcement actions highlights a shift in the Division’s focus at least last year. The Division brought a total of 159 actions involving investment advisor and investment companies in 2021 and 150 actions involving securities offerings, both five-year highs. On the other hand, the Division brought only five Foreign Corrupt Practices Act actions, 28 insider trading actions, and 70 actions involving issuer reporting/auditing and accounting, all five-year lows. In addition, the Division brought 110 actions involving broker dealers in 2021, a 22% decrease from the prior year, although more than in any of 2016-19. The number of market manipulation, public finance abuse, and nationally recognized statistical ratings organization actions remained generally consistent with prior years.

The Division also touted a number of “novel” actions, some of which are consistent with priorities articulated in speeches, including: charges involving securities using decentralized finance, or “DeFi,” technology; Regulation Crowdfunding; securities fraud by an alternative data provider; violations related to Form CRS; and enforcement of a key rule on the duties of municipal advisors.

The Division also reported a substantial increase in the number of whistleblower tips received in 2021, which will likely lead to an increase in enforcement actions in 2022 and beyond. The Division received 12,201 whistleblower tips in 2021, an increase of more than 75% from the record 6,911 tips reported in the prior fiscal year. Furthermore, the Commission awarded approximately $564 million to 108 individuals in fiscal year 2021, exceeding the combined total paid in the program’s 10-year history.

Notably, there was a decline in the number of whistleblowers reporting within their companies before contacting the Commission. With respect to successful whistleblower tips leading to enforcement actions, roughly 16 of 65 successful “insider” whistleblowers bypassed internal reporting and went straight to the Commission in fiscal year 2021. This data suggests that firms may need to examine their reporting structures to account for the increase in teleworking, which may be causing a disconnect between employees and internal reporting structures. This may also be a result of the Supreme Court’s decision in Digital Realty v. Somers, which denied Dodd-Frank legal protections to whistleblowers who reported internally but did not report their complaint to the SEC.

In sum, the Division’s report illustrates that there is a substantial amount of continuity in the SEC’s enforcement program over time. The COVID-19 pandemic may have affected the number of enforcement actions that the Division brought, but even still, the Division obtained the highest penalties in five years. Perhaps the biggest takeaway is the increase in whistleblower tips, which are taking an ever-increasing portion of the Division’s resources. This data, and the increase in whistleblowers who went directly to the Commission, shows it is incumbent upon firms regulated by the SEC to revise internal reporting structures to encourage employees to take full advantage of internal reporting prior to contacting the Commission. The full SEC Division of Enforcement 2021 Annual Report is available here.

Attorney Advertising—Sidley Austin LLP is a global law firm. Our addresses and contact information can be found at www.sidley.com/en/locations/offices.

Sidley provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers. Sidley and Sidley Austin refer to Sidley Austin LLP and affiliated partnerships as explained at www.sidley.com/disclaimer.

© Sidley Austin LLP

Contacts

Offices

Capabilities

Suggested News & Insights

- Stay Up To DateSubscribe to Sidley Publications

- Follow Sidley on Social MediaSocial Media Directory