Antitrust/Competition Update

November Antitrust Bulletin: Top-of-Mind Global Antitrust Issues

Our Take on Top-of-Mind Global Antitrust Issues

DOJ secures guilty plea in first criminal attempted monopolization case in over four decades: On October 31, the DOJ, in cooperation with other agencies, secured a guilty plea from the president of a paving and asphalt contractor in Montana for attempting to monopolize the market for highway crack-sealing services in Montana and Wyoming. Among other conduct, the defendant proposed to a competitor that the two companies divide up territories and bids for certain government projects. There was no agreement between the companies, making a traditional Sherman Act Section 1 case impossible. This was the first successful criminal case brought under Section 2 of the Sherman Act since the 1970s.

Why it matters: This guilty plea shows an increasing willingness on the part of the DOJ’s Antitrust Division to revive previously dormant enforcement measures to target conduct that it could not reach using its standard playbook. Assistant Attorney General Jonathan Kanter had previously stated his determination to criminally prosecute monopolization cases under Section 2 and expand the scope of enforcement measures available to DOJ prosecutors. Whether this case signals a permanent shift in DOJ enforcement priorities or is simply a one-off case based on unique facts remains to be seen.

New Section 5 policy statement: The FTC released a new policy statement explaining how it will use its authority under Section 5 of the FTC Act to police “unfair methods of competition” and specifically how Section 5 can proscribe conduct beyond that actionable under the Sherman and Clayton Acts. The policy statement identifies a number of practices that could constitute unfair methods of competition, which includes conduct that violates the spirit but not letter of the other antitrust laws and incipient violations of the antitrust laws. The policy statement notes that under Section 5, the FTC’s “inquiry will not focus on the ‘rule of reason’ inquiries ... but will instead focus on stopping unfair methods of competition in their incipiency ....” The definition of “unfair competition” is flexible, but the policy statement notes that it is “conduct that goes beyond competition on the merits,” and it may include practices that are “coercive, exploitative, collusive, abusive, deceptive, predatory” or practices that are “otherwise restrictive or exclusionary,” and it “must tend to negatively affect competitive conditions.”

Why it matters: The new policy statement reflects a continued push by current FTC leadership to expand antitrust enforcement beyond the consumer welfare framework that has guided policymakers for decades and was accompanied by a spirited dissenting statement from Commissioner Christine Wilson. It replaces the commission’s prior Section 5 policy, issued in 2015, which was adopted unanimously by the Commissioners and widely viewed as taking a limiting view of standalone Section 5 authority but which the FTC withdrew in July 2021.

The EC launched a public consultation on the revision of its Market Definition Notice: On November 8, 2022, the EC launched a public consultation on a revised Market Definition Notice. The current Market Definition Notice, which dates from 1997, provides guidance on the principles and best practices the EC uses when defining relevant markets in competition law cases. The main proposed changes include (i) greater emphasis on nonprice elements (e.g., innovation, quality), (ii) new guidance regarding digital markets, (iii) more guidance on geographic market definition (e.g., conditions to define global markets; approach to imports), and (iv) clarifications on quantitative techniques (e.g., the small but significant non-transitory increase in price test).

Why it matters: The revised Market Definition Notice is intended to bring more transparency and legal certainty for businesses active in the European Union, especially for those in innovation-driven markets (e.g., those in the digital and pharmaceutical sectors). It may lead to a more thorough application of market definition principles, notably with regard to abuse of dominance investigations and merger control investigations. Interested parties now have the opportunity to influence the evolution of the revised Market Definition Notice by providing their feedback on the draft by January 13, 2023.

Assessing deals based on potential harm to suppliers and employees: The DOJ and the FTC have continued to experiment with previously underutilized theories of harm, including buy-side power (sometimes called “monopsony”) theories of harm. These theories allege that a buyer has market power over sellers as opposed to customers. The agencies have recently focused on monopsony power in transactions with a particular focus on labor markets. In January 2022, Assistant Attorney General Kanter stated, “[t]he monopsony power of employers in labor markets tends to depress wages, erode quality of life, and make it harder for workers to switch jobs.” The DOJ also successfully relied on a buy-side power theory of harm in a nonlabor market to block a merger transaction in litigation.

Why it matters: Prior to the DOJ’s recent injunctive action in a potential transaction, there were only a few, older court cases that prohibited mergers relying solely on a buy-side power theory of harm. Given this success, the agencies may be more likely to pursue it, including in labor contexts. When planning to defend a transaction, businesses will need to plan for potential questions regarding harm not only to traditional market of downstream consumers but also to upstream suppliers such as wholesalers, manufacturers, and laborers.

First guilty plea in criminal wage-fixing case: The DOJ secured its first victory in a criminal wage-fixing case against VDA OC LLC (VDA), a healthcare staffing firm that pleaded guilty to violating Section 1 of the Sherman Act by conspiring with another healthcare staffing agency to unlawfully fix their wages and allocate nurses. VDA will pay a criminal fine of $62,000 as well as restitution of $72,000 to the injured nurses.

Why it matters: The guilty plea follows recent DOJ criminal losses in the employment context where juries acquitted defendants of criminal no-poach charges. The DOJ’s win will be seen as a key vindication of its policy to criminally prosecute wage fixing and no-poach agreements, which has also been recently adopted by Canadian authorities, who have amended their Competition Act to criminally prohibit wage-fixing and no-poach agreements between employers. The Canadian Competition Act amendments will become law in June 2023.

Read more Antitrust Bulletins here.

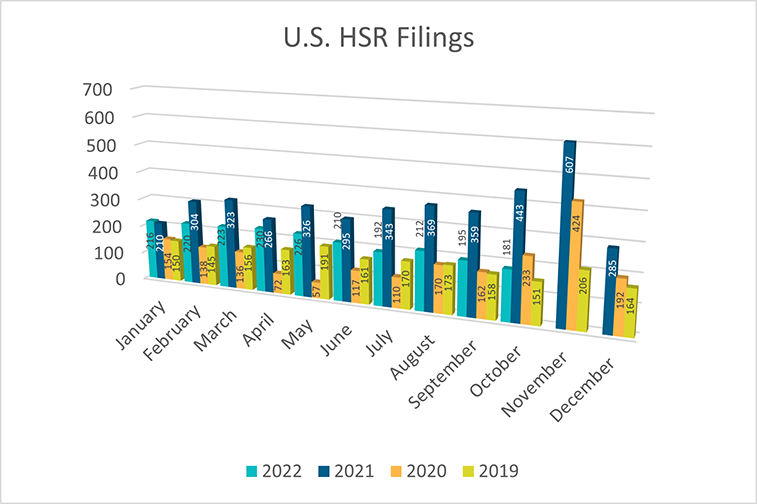

Premerger Filing Notifications

Attorney Advertising—Sidley Austin LLP is a global law firm. Our addresses and contact information can be found at www.sidley.com/en/locations/offices.

Sidley provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers. Sidley and Sidley Austin refer to Sidley Austin LLP and affiliated partnerships as explained at www.sidley.com/disclaimer.

© Sidley Austin LLP

Contacts

Offices

Capabilities

Suggested News & Insights

- Stay Up To DateSubscribe to Sidley Publications

- Follow Sidley on Social MediaSocial Media Directory