Employee Benefits Update

IRS/ Treasury Guidance Expands the List of Preventive Care Benefits That May Be Provided Under High Deductible Health Plans

On July 17, 2019, the Department of the Treasury (the “Treasury Department”) and the Internal Revenue Service (the “IRS”) jointly issued Notice 2019-45, which notice expands the preventive care benefits that may be provided through a high deductible health plan (an “HDHP”) without a deductible or with a deductible that falls below the applicable minimum deductible for an HDHP under the Internal Revenue Code. One of the requirements for an HDHP is that the plan generally not provide reimbursement for healthcare expenses for any year until the minimum deductible set forth in the Internal Revenue Code is satisfied. However, the Internal Revenue Code contains an exception from the minimum deductible requirement for “preventive care.” Employees who participate in HDHPs frequently establish health savings accounts that may be used to pay qualified medical expenses (including deductibles and other out-of-pocket healthcare expenses).

Notice 2019-45 responds to President Trump’s recent Executive Order that directed the Secretary of Treasury to issue guidance to expand the ability of patients to select HDHPs that: (i) can be used alongside a health savings account and (ii) cover low-cost preventive care, before the deductible, that helps to maintain health status for individuals with chronic conditions.

In prior guidance, under Notice 2004-23, the Treasury Department and the IRS had stated that “preventive care” does not generally include any service or benefit intended to treat an existing illness, injury, or condition. However, in this new notice, the Treasury Department and the IRS acknowledge that cost barriers to care have resulted in some individuals with chronic conditions failing to seek effective and necessary care that would prevent the exacerbation of that condition. They also note that failure to address these chronic conditions has been demonstrated to lead to consequences such as amputation, blindness, heart attacks and strokes that require considerably more extensive medical intervention.

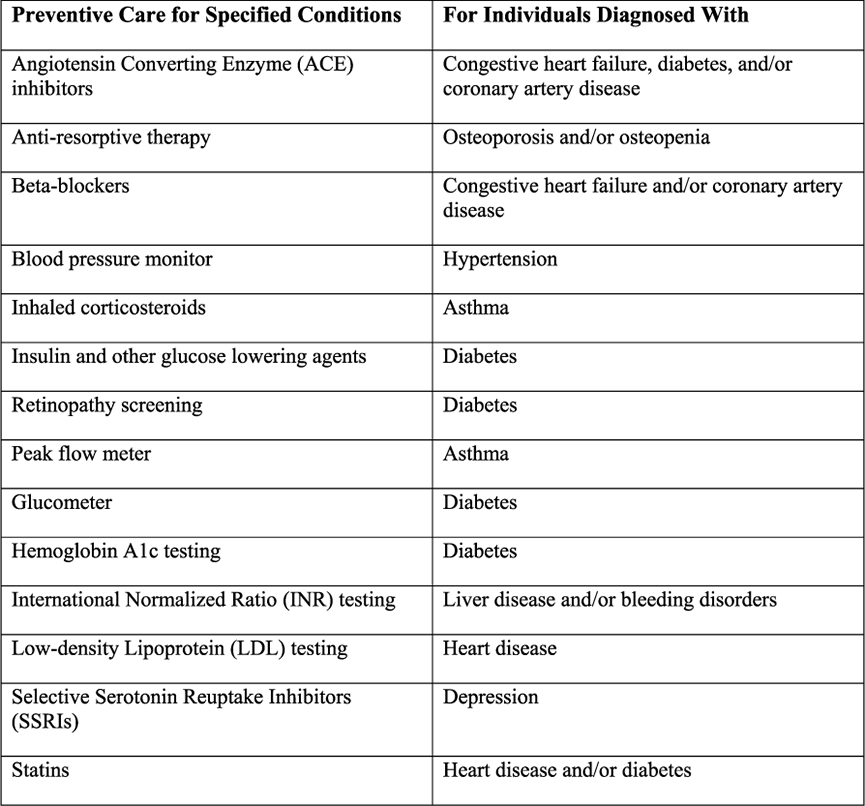

As a result, the Treasury Department and the IRS, in consultation with the Department of Health and Human Services, have detailed specific medical care services received and items purchased that may now be classified as “preventive care” for purposes of HDHPs if prescribed to treat an individual diagnosed with the associated chronic condition, as specified below.

The specified services and items listed above are only treated as preventive care when they have been prescribed (i) to treat an individual diagnosed with the associated chronic condition specified above, and (ii) for the purpose of preventing the exacerbation of the chronic condition or the development of a secondary condition. Services or items that are not listed in Notice 2019-45 that are for secondary conditions or complications are not treated as preventive care for purposes of the HDHP rules.

Notice 2019-45 does not change the services and items that are considered preventive care for purposes of the provisions of the Patient Protection and Affordable Care Act requiring non-grandfathered group health plans to provide benefits for certain preventive health services without imposing cost-sharing requirements.

Considerations for Plan Sponsors

Plan sponsors that maintain HDHPs may wish to review their existing policies and practices with respect to those plans to ensure proper administration given the new guidance.

Attorney Advertising—Sidley Austin LLP is a global law firm. Our addresses and contact information can be found at www.sidley.com/en/locations/offices.

Sidley provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers. Sidley and Sidley Austin refer to Sidley Austin LLP and affiliated partnerships as explained at www.sidley.com/disclaimer.

© Sidley Austin LLP

Contacts

Capabilities

Suggested News & Insights

- Stay Up To DateSubscribe to Sidley Publications

- Follow Sidley on Social MediaSocial Media Directory