Corporate Governance Update

SEC Amends Filer Definitions to Exempt More Issuers From Sarbanes-Oxley 404(b) Auditor Attestation Requirement

On March 12, 2020, the Securities and Exchange Commission (SEC) adopted final amendments to the definitions of “accelerated filer” and “large accelerated filer” in Exchange Act Rule 12b-2 substantially as proposed by the SEC in May 2019. The amendments are summarized below and set forth in detail in Appendix A. The most significant effect of the amendments is to exempt a greater number of smaller issuers from the requirement to provide an auditor’s attestation of management’s assessment of internal control over financial reporting (ICFR) under Section 404(b) of the Sarbanes-Oxley Act (SOX 404(b)).

The SEC’s stated goal is to promote capital formation by “reducing unnecessary burdens and compliance costs for certain smaller issuers while maintaining investor protections.” The Jumpstart Our Business Startups (JOBS) Act of 2012 exempted emerging growth companies from the SOX 404(b) audit attestation requirement for up to five years after going public. The amendments will allow smaller issuers that have been public for more than five years but have not yet reached $100 million in revenues to continue to benefit from the JOBS Act exemption and redirect resources toward growth initiatives. Foreign private issuers that meet the required thresholds and other qualifications can avail themselves of the amendments only if they file on domestic forms and present their financial statements pursuant to U.S. GAAP.

Background

Under the current definitions of accelerated filer and large accelerated filer, an issuer must have had a public float of $75 million or more but less than $700 million to be an accelerated filer, or $700 million or more to be a large accelerated filer, in each case as of the last business day of the issuer’s most recently completed second fiscal quarter. Accelerated filers and large accelerated filers are subject to the SOX 404(b) auditor attestation requirement and accelerated reporting deadlines for their Exchange Act periodic reports relative to non-accelerated filers.

In June 2018, the SEC adopted amendments to the definition of “smaller reporting company” (SRC) in Rule 12b-2 to expand the number of issuers eligible to qualify as an SRC and take advantage of the related scaled disclosure requirements. At the time, the SEC did not increase the threshold for accelerated filer status, which created an overlap among the filer categories. Some issuers qualified as both SRCs and accelerated or large accelerated filers, meaning they enjoyed relief in the form of scaled disclosure but remained subject to the SOX 404(b) auditor attestation requirement. Acknowledging the complexity caused by the SRC amendments, SEC Chair Jay Clayton directed the Staff of the SEC’s Division of Corporation Finance to formulate recommendations for potential rule amendments to reduce the number of issuers that would qualify as accelerated filers. The SEC proposed rule amendments in May 2019 that were summarized in the Sidley Update available here.

Final Amendments

The amendments exclude from the accelerated filer and large accelerated filer definitions an issuer that is eligible to be a SRC and had annual revenues of less than $100 million in the most recently completed fiscal year. Therefore, SRCs with less than $100 million in revenues will be exempt from the SOX 404(b) auditor attestation requirement and accelerated reporting deadlines (meaning an additional 15 days to file annual reports and five days to file quarterly reports).1 They will still be required to comply with other SOX mandates, including CEO and CFO certifications, the requirement to establish and maintain ICFR and have management assess its effectiveness, and a financial statement audit by an independent auditor, who is required to consider ICFR in the performance of that audit.

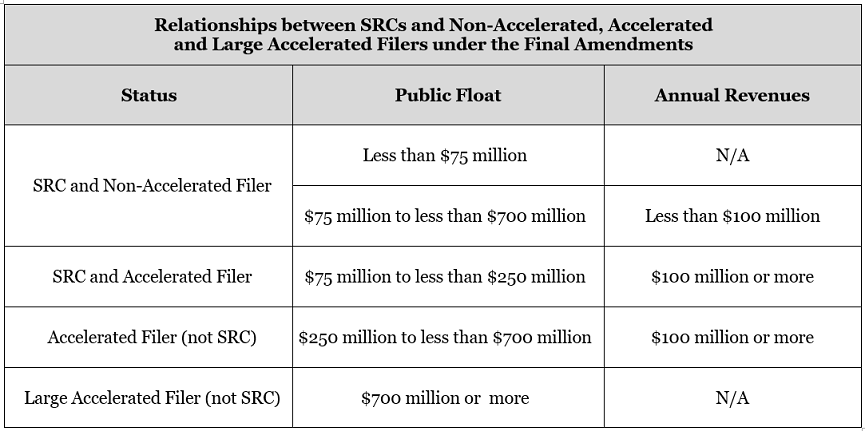

Appendix B includes a table excerpted from the adopting release that outlines the relationships between the filer categories under the amendments. The SEC declined to fully align the SRC and non-accelerated filer definitions as proposed by some commenters.

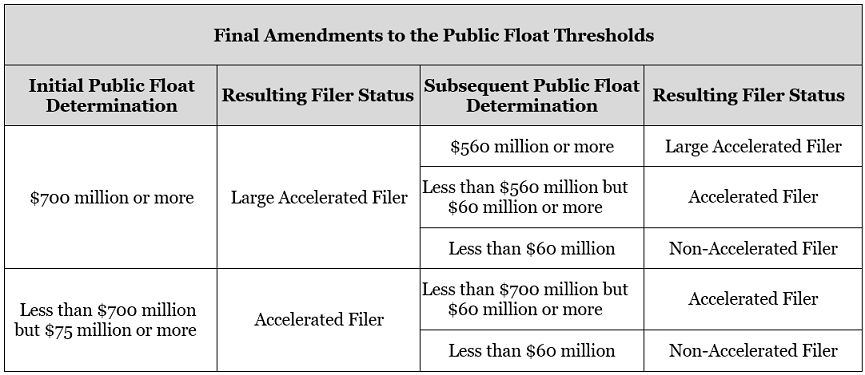

The SEC also amended the transition thresholds for exiting accelerated or large accelerated filer status. Currently, an issuer will remain a large accelerated filer until its public float falls below $500 million, at which time it will become an accelerated filer. The amendments adjust the transition threshold for exiting large accelerated filer status to $560 million to align with the SRC transition threshold. Under the current rules, an issuer that is an accelerated or large accelerated filer will become a non-accelerated filer if its public float falls below $50 million. The amendments adjust the transition threshold for becoming a non-accelerated filer to $60 million. Appendix C includes a table excerpted from the adopting release that outlines the amendments to the public float transition thresholds. The amendments also add the revenue test of the SRC definition as another prong when determining whether an issuer is eligible to exit accelerated or large accelerated filer status.

The amendments add a checkbox to the cover pages of annual reports on Forms 10-K, 20-F and 40-F to indicate whether a SOX 404(b) auditor attestation is included in the filing. This checkbox will be subject to any applicable requirements to tag cover page data using Inline XBRL.

The amendments exclude business development companies (BDCs) (which are not eligible to be SRCs) from the accelerated filer and large accelerated filer definitions under circumstances that are analogous to the exclusions for other issuers under the amendments. See Appendix A for the applicable amendment, which includes a revenue test specific to BDCs.

Finally, the SEC added a new instruction to the “smaller reporting company” definition to clarify its position that foreign private issuers that meet the required thresholds and other qualifications can avail themselves of the amendments only if they file on domestic forms and present their financial statements pursuant to U.S. GAAP.

Effective Date

The amendments will become effective 30 days following publication in the Federal Register and will apply to annual report filings due on or after the effective date. An issuer may apply the amendments to determine its filer status even if its fiscal year end (e.g., March 31, 2020) precedes the effective date. If an issuer determines it is eligible to be a non-accelerated filer under the amendments, it will not be subject to the SOX 404(b) auditor attestation requirement for its annual report due and filed after the effective date of the amendments and may comply with the filing deadlines and other accommodations applicable to non-accelerated filers.

1 As a result of the amendments, an SRC with less than $100 million in revenues will also not have to provide the disclosure required by Item 1B of Form 10-K and Item 4A of Form 20-F about unresolved staff comments on its SEC filings or the disclosure required by Item 101(e)(4) of Regulation S-K about whether it makes filings available on its corporate website.

APPENDIX A

Final Amendments to “Accelerated Filer” and

“Large Accelerated Filer” Definitions in Exchange Act Rule 12b-2

Accelerated filer and large accelerated filer -

(1) Accelerated filer. The term accelerated filer means an issuer after it first meets the following conditions as of the end of its fiscal year:

(i) The issuer had an aggregate worldwide market value of the voting and non-voting common equity held by its non-affiliates of $75 million or more, but less than $700 million, as of the last business day of the issuer’s most recently completed second fiscal quarter;

(ii) The issuer has been subject to the requirements of section 13(a) or 15(d) of the Act (15 U.S.C. 78m or 78o(d)) for a period of at least twelve calendar months; and

(iii) The issuer has filed at least one annual report pursuant to section 13(a) or 15(d) of the Act.; and

(iv) The issuer is not eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B) of the “smaller reporting company” definition in this section, as applicable.

(2) Large accelerated filer. The term large accelerated filer means an issuer after it first meets the following conditions as of the end of its fiscal year:

(i) The issuer had an aggregate worldwide market value of the voting and non-voting common equity held by its non-affiliates of $700 million or more, as of the last business day of the issuer’s most recently completed second fiscal quarter;

(ii) The issuer has been subject to the requirements of section 13(a) or 15(d) of the Act for a period of at least twelve calendar months; and

(iii) The issuer has filed at least one annual report pursuant to section 13(a) or 15(d) of the Act.; and

(iv) The issuer is not eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B) of the “smaller reporting company” definition in this section, as applicable.

(3) Entering and exiting accelerated filer and large accelerated filer status.

(i) The determination at the end of the issuer’s fiscal year for whether a non-accelerated filer becomes an accelerated filer, or whether a non-accelerated filer or accelerated filer becomes a large accelerated filer, governs the deadlines for the annual report to be filed for that fiscal year, the quarterly and annual reports to be filed for the subsequent fiscal year and all annual and quarterly reports to be filed thereafter while the issuer remains an accelerated filer or large accelerated filer.

(ii) Once an issuer becomes an accelerated filer, it will remain an accelerated filer unless: the issuer determines, at the end of a fiscal year, that the aggregate worldwide market value of the voting and non-voting common equity held by its non-affiliates of the issuer was less than $5060 million, as of the last business day of the issuer’s most recently completed second fiscal quarter. An issuer making this determination; or it determines that it is eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B) of the “smaller reporting company” definition in this section, as applicable. An issuer that makes either of these determinations becomes a non-accelerated filer. The issuer will not become an accelerated filer again unless it subsequently meets the conditions in paragraph (1) of this definition.

(iii) Once an issuer becomes a large accelerated filer, it will remain a large accelerated filer unless the issuer: it determines, at the end of a fiscal year, that the aggregate worldwide market value of the voting and non-voting common equity held by its non-affiliates of the issuer(“aggregate worldwide market value”) was less than $500560 million, as of the last business day of the issuer’s most recently completed second fiscal quarter or it determines that it is eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B) of the “smaller reporting company” definition in this section, as applicable. If the issuer’s aggregate worldwide market value was $5060 million or more, but less than $500560 million, as of the last business day of the issuer’s most recently completed second fiscal quarter, the issuer and it is not eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B), of the “smaller reporting company” definition in this section, as applicable, it becomes an accelerated filer. If the issuer’s aggregate worldwide market value was less than $5060 million, as of the last business day of the issuer’s most recently completed second fiscal quarter, the issuer or it is eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B) of the “smaller reporting company” definition in this section, it becomes a non-accelerated filer. An issuer will not become a large accelerated filer again unless it subsequently meets the conditions in paragraph (2) of this definition.

(iv) The determination at the end of the issuer’s fiscal year for whether an accelerated filer becomes a non-accelerated filer, or a large accelerated filer becomes an accelerated filer or a non-accelerated filer, governs the deadlines for the annual report to be filed for that fiscal year, the quarterly and annual reports to be filed for the subsequent fiscal year and all annual and quarterly reports to be filed thereafter while the issuer remains an accelerated filer or non-accelerated filer.

(4) For purposes of paragraph (1), (2), and (3) only, a business development company is considered to be eligible to use the requirements for smaller reporting companies under the revenue test in paragraph (2) or (3)(iii)(B) of the “smaller reporting company” definition in this section, provided that the business development company meets the requirements of the test using annual investment income under Rule 6-07.1 of Regulation S-X (17 CFR 210.6-07.1) as the measure of its “annual revenues” for purposes of the test.

APPENDIX B

Table Excerpted From the Adopting Release Highlighting

Relationships Between the Filer Categories Under the Final Amendments

APPENDIX C

Table Excerpted From the Adopting Release Highlighting

Final Amendments to the Public Float Transition Thresholds

Attorney Advertising—Sidley Austin LLP is a global law firm. Our addresses and contact information can be found at www.sidley.com/en/locations/offices.

Sidley provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers. Sidley and Sidley Austin refer to Sidley Austin LLP and affiliated partnerships as explained at www.sidley.com/disclaimer.

© Sidley Austin LLP

Contacts

Capabilities

Suggested News & Insights

- Stay Up To DateSubscribe to Sidley Publications

- Follow Sidley on Social MediaSocial Media Directory